Report: Summary Of Report Of "Payments In Nigeria: Market Drivers (July 2024)"

Courtesy: Stears

We delve into Nigeria's digital payment market, examining the critical drivers behind its significant growth.

Market Growth:

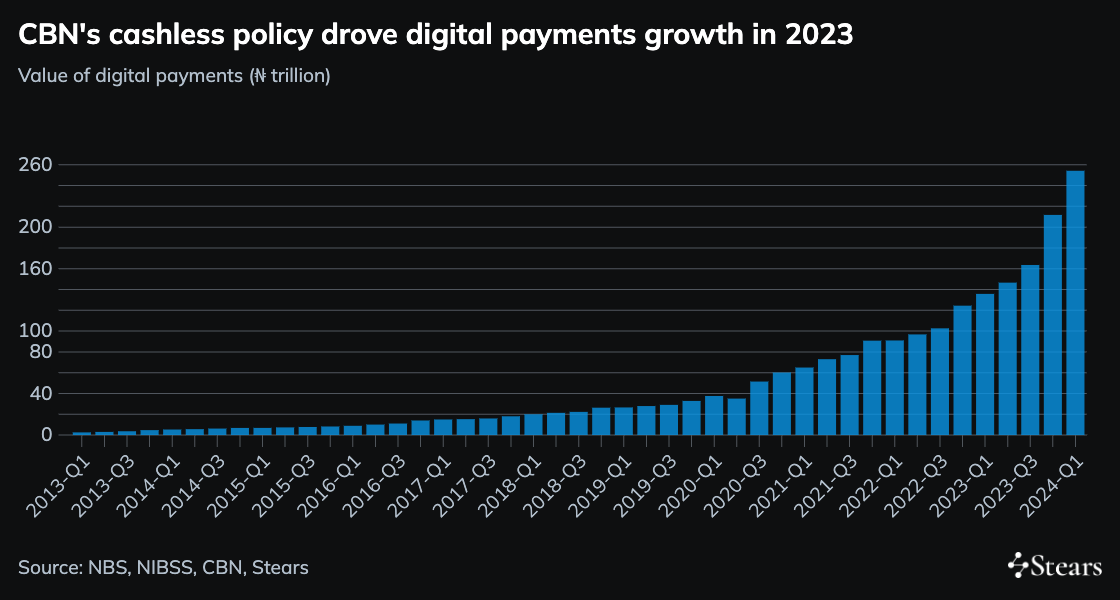

Nigeria's digital payment market has experienced exponential growth, increasing by 47.4 times to reach ₦657.8 trillion ($410 billion) from 2013 to 2023. This surge is primarily fueled by digital innovation and proactive initiatives from the Central Bank of Nigeria to enhance financial inclusion and reduce cash dependency.

Emerging Trends:

Rising Smartphone Penetration: The penetration rate is projected to reach 66% by 2025, significantly expanding the digital transaction user base.

Mobile Phone Accessibility: With 93% of adults having access to mobile phones, digital payment solutions, particularly targeting underserved segments, are widely adopted.

Open Banking Guidelines: These guidelines promote data sharing and collaboration between traditional banks and fintech firms, fostering a climate of financial innovation.

Sector Outlook:

Youth Demographic: Nigeria's young population promises a sustained demand for digital payment services, promising continued market growth.

Fintech Innovation: Fintech-led innovations are driving scalable solutions with substantial growth potential, presenting attractive investment opportunities.

Regulatory Support: The Central Bank of Nigeria's regulatory initiatives could support a conducive environment for digital payments, fostering competition and innovation within the sector.